For the fifth consecutive year, Taylor King has been selected to the Super Lawyers Florida Rising Stars list. Each year, no more than 2.5 percent of the lawyers in the state are selected by the research team at Super Lawyers to receive this honor.

Super Lawyers, a Thomson Reuters business, is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement. The annual selections are made using a patented multiphase process that includes a statewide survey of lawyers, an independent research evaluation of candidates and peer reviews by practice area. The result is a credible, comprehensive and diverse listing of exceptional attorneys.

The Super Lawyers lists are published nationwide in Super Lawyers Magazines and in leading city and regional magazines and newspapers across the country. Super Lawyers Magazines also feature editorial profiles of attorneys who embody excellence in the practice of law. For more information about Super Lawyers, visit http://www.superlawyers.com/.

Taylor King named Super Lawyers Rising Star 2021

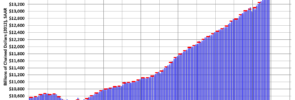

2021 BANKRUPTCY PREDICTIONS – HISTORICALLY LOW BANKRUPTCY FILING EXPLAINED BY DROPPING CONSUMER DEBT LEVELS

As any Bankruptcy attorney can tell you, the number of people seeking and filing for bankruptcy relief has dramatically declined during the recent pandemic and recovery. In fact, filings are at a 35 year low and dropped nearly 30% from 2019 to 2020 based on overall filings. Enhanced unemployment compensation, mortgage relief and other government […]

Continue reading...Taylor King named Super Lawyers Rising Star 2020

For the fourth consecutive year, Taylor King has been selected to the Super Lawyers Florida Rising Stars list. Each year, no more than 2.5 percent of the lawyers in the state are selected by the research team at Super Lawyers to receive this honor. Super Lawyers, a Thomson Reuters business, is a rating service of outstanding […]

Continue reading...CORONAVIRUS AND THE SAFETY NET PROVIDED BY THE BANKRUPTCY CODE

CORONAVIRUS AND THE SAFETY NET PROVIDED BY THE BANKRUPTCY CODE The news of the coronavirus pandemic has exploded into the American consciousness over the past few days. Our office hopes that everyone has been able to stay healthy in the face of this health scare. After the initial health concerns that people will rightly worry […]

Continue reading...BANKRUPTCY PREDICTIONS FOR 2020

BANKRUPTCY PREDICTIONS FOR 2020: CONSUMER CREDIT AND SPENDING CONTINUE TO INCREASE Each year our office looks at the coming trends for consumer bankruptcy to figure out if bankruptcy filings are on the rise of will continue to fall. Based on my past research in this area, bankruptcy filings are tied closely to the level of […]

Continue reading...EDUCATION UNDER ATTACK IN BANKRUPTCY FILINGS

EDUCATION UNDER ATTACK BY THE BANKRUPTCY CODE It seems that families trying to educate their children can’t catch a break with the Bankruptcy Code. In 2005, the Bankruptcy Code was amended to add a means test to Chapter 7 and Chapter 13 cases. One of the biggest changes to expenses allowed to a potential 7 […]

Continue reading...HAVEN ACT: Military Disability Proposed to be Excluded from Means Test in Bankruptcy

In March of 2019, a new Bill was introduced in the United States Senate to exclude military disability benefits from the means test in Chapter 7 and Chapter 13 Bankruptcy cases. A summary of the proposal is at the link below: https://www.baldwin.senate.gov/press-releases/haven-act The proposed bill would treat military disability the same as Social Security Disability. […]

Continue reading...CHAPTER 11 FOR SMALL BUSINESS LOANS EXPLAINED – USING CHAPTER 11 TO RESTRUCTURE BUSINESS LOANS AND CONTINUE YOUR OPERATIONS

Running a small business is tough. You have a constant balance of obtaining new business and serving the current customers that you have at the level that both parties expect. Often, a small business will need additional capital. This can be to weather a downturn or to expand if business is going well. A quick […]

Continue reading...WHY CAN’T PEOPLE AFFORD SUMMER VACATIONS

WHY CAN’T PEOPLE AFFORD SUMMER VACATIONS? It is almost Summer vacation time for most people. However, it seems that the traditional Summer vacation is becoming increasingly rare. The below article found that 39 million people in the United States won’t be able to afford a Summer vacation in 2019. https://www.usatoday.com/story/money/2019/04/30/millions-of-americans-wont-take-a-summer-vacation/39400659/ According the article, the reason […]

Continue reading...MEDICAL DEBTS AND TAX REFUND SEIZURE

MEDICAL DEBTS AND TAX REFUND SEIZURES About 4 years ago I wrote a blog about the impending ability of debt collectors to seize federal tax refunds as a form of debt collection. It seems that the State legislatures have been moving rapidly to make that form of debt collection a reality. Here is my article […]

Continue reading...