BANKRUPTCY PREDICTIONS FOR 2020: CONSUMER CREDIT AND SPENDING CONTINUE TO INCREASE

Each year our office looks at the coming trends for consumer bankruptcy to figure out if bankruptcy filings are on the rise of will continue to fall.

Based on my past research in this area, bankruptcy filings are tied closely to the level of consumer debt. When that level becomes too high, payments for households become unsustainable and defaults begin to occur. That then leads to the rise in consumer filings. This is exactly what we saw in the 2007 time period. Revolving debt and house expense became more than families could afford and the housing market collapsed, taking jobs, banks and anything else connected to the housing market down.

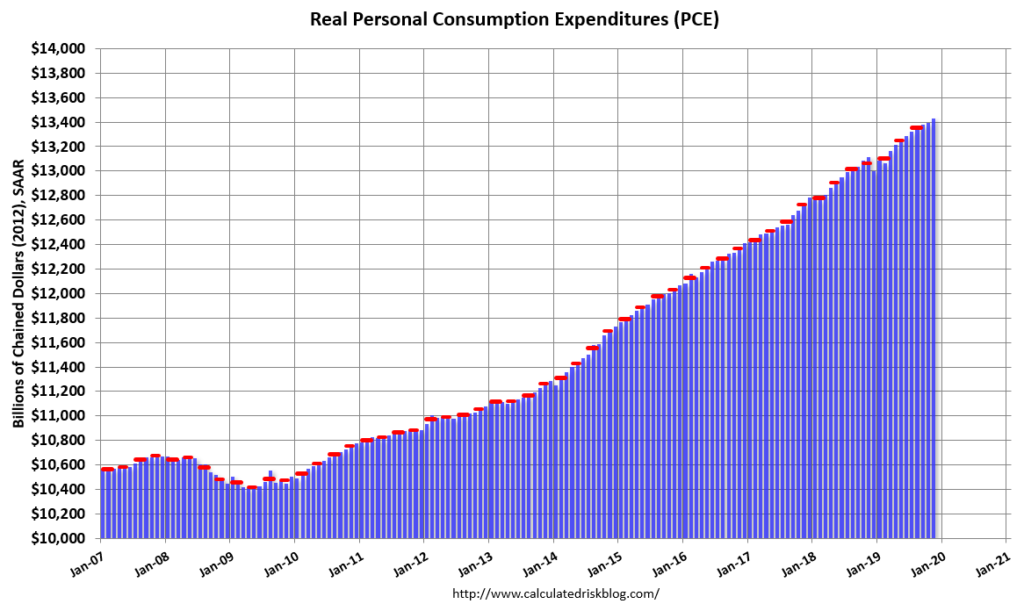

In 2019 the amount of consumer spending has continued to rise. The below chart shows that consumer spending has been on an upward trend for several years. This is tied to a growing economy and the continued cost of living increases for the last several years.

Consumer debt levels, closely tied to consumer spending, have also continued to increase in 2019. The following link shows that consumer debt levels increased for the 21st consecutive quarter (over 5 years of time) in the third quarter of 2019. Student loans, auto, credit card and all other types of non-household debt have increased dramatically over that time period.

https://www.newyorkfed.org/microeconomics/hhdc.html

The Federal Reserve has also started to note an increase in delinquency rates associated with all debt types in 2019. Overall default rates stood at 4.8% of all loans outstanding in the third quarter of 2019, an increase of .4%. Mortgage default rates appear to have kept this default number artificially low. Currently, mortgage default rates are near 1%, while default rates for credit cards, autos and student loans are typically in the 5-10% default rate range.

In 2019 our office continued to see increases in bankruptcy filings. The filings in the Jacksonville division have topped 4700 total so far this year. In 2018 the total filings were just over 4600 total filings. This is a modest increase, but indicative of the upward trend that we expect to continue over the next year based on debt levels and consumer spending.

At Mickler & Mickler, we attend Court and see the bankruptcy trustees and judges in action several times a week. We have the experience to guide you to the right decision about whether to file a case, and if so, what Chapter to file. When you contact our office, we can help you in your case with sound legal advice.

Please contact Mickler & Mickler at 904.725.0822 or bkmickler@planlaw.com. We will be happy to set you up a free appointment to discuss your situation and potential solutions.

Bryan Mickler